[ad_1]

Fast Details In regards to the Automotive Shopping for and Promoting Market

When analysts from Kelley Blue Guide mother or father firm Cox Automotive made their predictions about 2024, they used a phrase we haven’t seen a lot in recent times: regular.

“The pandemic created a vendor’s market wherein new autos have been transacting above producers’ recommended retail worth [MSRP] in 2022,” says Michelle Krebs, Cox Automotive govt analyst. “That market is all however gone now.”

Increased inventories of latest automobiles have many sellers competing with one another by discounting automobiles. She provides, “Automobiles at the moment are sometimes promoting for below MSRP. The shift from a vendor’s market to a purchaser’s market is properly underway.”

The information isn’t all good. Rates of interest stay traditionally excessive after a 12 months of Federal Reserve efforts to rein in inflation. New automobiles are extra reasonably priced for many people, however new automobile loans aren’t. Used automobile customers face a extra sophisticated market as the provision of used automobiles stays tighter than typical. However even that state of affairs is enhancing.

We’ll stroll you thru what to anticipate whereas shopping for or promoting a new or used automobile or buying and selling one in. Many automobile customers are in each markets concurrently, with a automobile to swap. They’re prone to discover balanced affords on their trade-in this month. Learn on to seek out out extra.

What New Automotive Customers Can Count on

We could all nonetheless have sticker shock from the COVID-19 pandemic and the consequences of associated provide chain issues on new automobile costs in 2021 and 2022. However the state of affairs is enhancing sooner than most of us notice. The worth of the typical new automobile fell by 2.4% in 2023 — essentially the most vital one-year drop on file.

The common new automobile purchaser paid $48,759 in December. That’s 1.3% greater than in November however nonetheless far lower than at the beginning of final 12 months.

Incentives made up 5.5% of the typical sale final month. That’s practically double the place they have been at first of 2023. Room stays for reductions to develop — they routinely topped 10% 4 years in the past — however they’re steadily rising.

RELATED: When Will New Automotive Costs Drop?

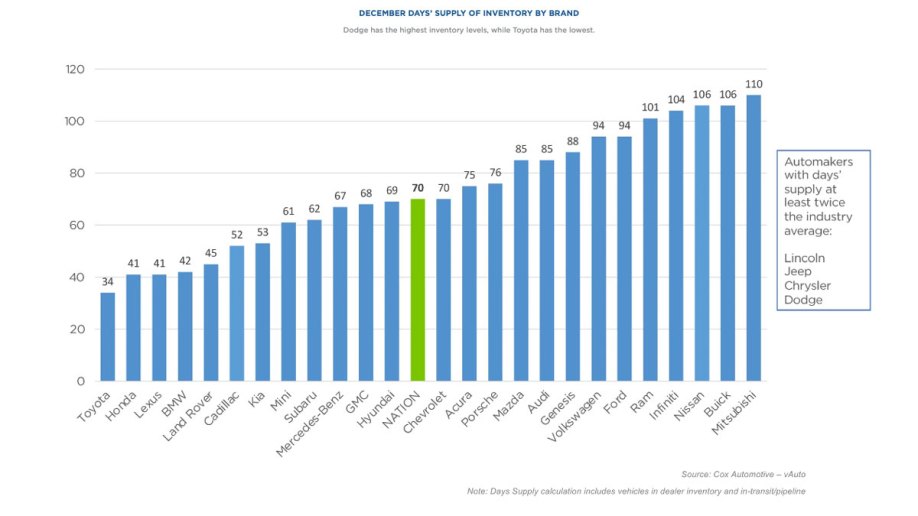

Reductions seem when sellers are oversupplied. An previous rule of thumb within the auto trade tells sellers to maintain about 60 days’ value of latest automobiles in inventory. Veteran salespeople say that’s the extent at which your native dealership possible has the mix of colours and options you’re in search of in inventory.

Many manufacturers are properly over that determine now. The common automaker has a 70-day provide; 5 manufacturers stood at over 100 days on the finish of 2023.

It’s nonetheless exhausting to discover a whole lot at gross sales tons from a number of manufacturers—for example, Toyota and its Lexus luxurious marque battle to inventory sufficient automobiles. Many Toyota and Lexus autos are promoting over MSRP. However customers acquire leverage when a supplier has extra automobiles to promote, and the typical model at present has greater than it desires.

Curiosity Charges Lastly Falling

Affordability isn’t nearly worth. Most of us borrow to pay for a brand new automobile and work to repay that mortgage. Excessive rates of interest saved many consumers out of the market in 2023.

They’re, ever so barely, beginning to come down.

The Federal Reserve has held rates of interest regular since midsummer. That stability has lenders beginning to imagine the worst of inflation is behind us. In November, lenders lowered charges. The common new automobile mortgage fee nearly reached 10% in October and has fallen to 9.7%. The common used automobile mortgage fee peaked at 14.4% in mid-November and is now right down to 14%.

These are nonetheless excessive charges, however the development is shifting in customers’ favor.

Our favourite measure of automobile costs doesn’t take into account money. It seems to be at time. The common earner would now have to work 38.6 weeks to repay the typical new automobile. That’s traditionally excessive — the quantity hovered between 33 and 36 weeks for many of a decade earlier than 2021. Nevertheless it’s down from a excessive of 44 weeks in December 2022.

What Used Automotive Customers Can Count on

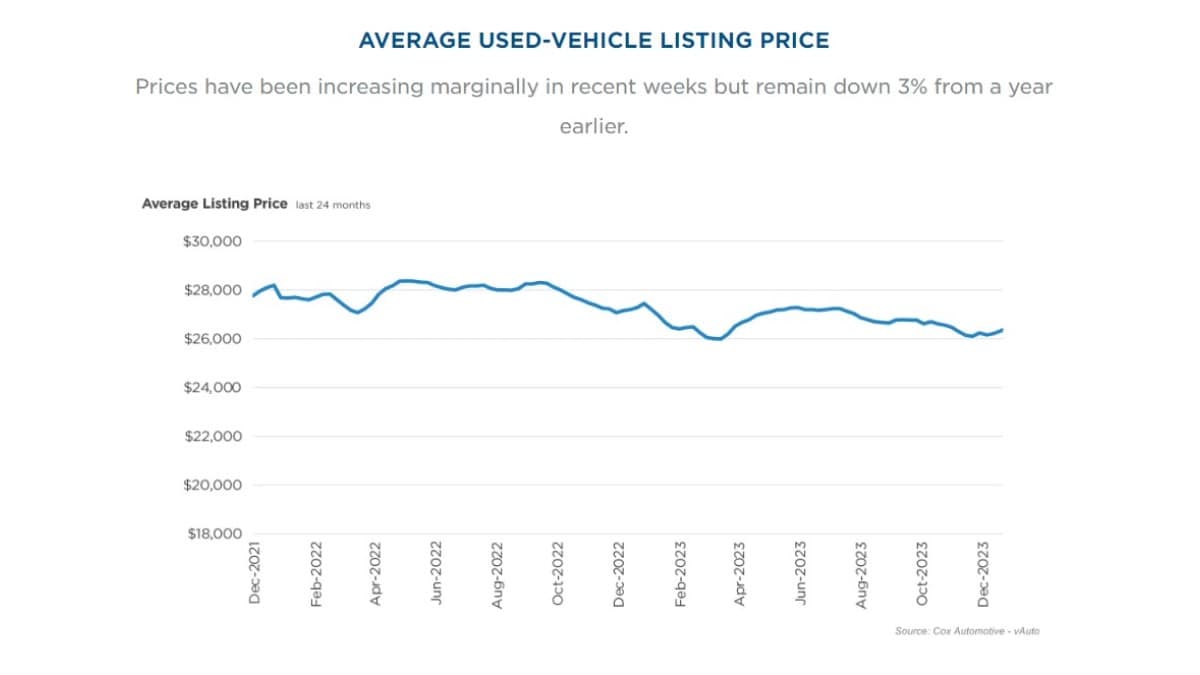

Used automobile costs, in the meantime, are fluctuating barely. That’s nice information after a protracted interval of dramatic adjustments.

The common worth marketed for a used automobile in December was $26,446 — about $200 greater than a month earlier, based on the Cox Automotive evaluation of vAuto Accessible Stock knowledge.

That’s a short-term improve however a part of a long-term lower. The common record worth was 3% decrease than one 12 months earlier than.

Automotive sellers nonetheless face a scarcity of used automobiles. However that state of affairs is enhancing, too.

“After bottoming out at a low historic degree within the first quarter of 2023, the provision of used items usually rose all through most of 2023, ending at roughly the 12 months’s highest ranges in each quantity and days of provide,” stated Jeremy Robb, senior director of Cox Automotive Financial and Trade Insights.

On the finish of December, the typical supplier held a 56-day provide of used automobiles — slightly below the normal goal of 60 days.

Essentially the most reasonably priced used automobiles stay the toughest to seek out, with sellers struggling to maintain automobiles priced below $15,000 in inventory.

Automakers Are Constructing Extra Costly Automobiles

Although short-term traits are pushing new automobile costs down, automakers are focusing efforts on constructing extra premium automobiles. The period of the cheap automobile is disappearing.

A latest evaluation finds that gross sales of automobiles priced at $25,000 or much less have fallen by 78% in simply 5 years. 5 years in the past, automakers supplied 36 new fashions in that worth vary. This 12 months, that quantity is simply 10. In the meantime, these priced at $60,000 or larger have grown by 163% throughout the identical interval.

Cox Chief Economist Jonathan Smoke explains the latest Federal Reserve rate of interest hikes preserve some customers from shopping for automobiles. “This development induces automakers to give attention to worthwhile merchandise for customers who can afford to purchase, which retains much less prosperous customers out of the new-vehicle market altogether and limits what is on the market and potential within the used marketplace for years to return,” Smoke cautions.

Sellers are pushing again, telling automakers they want extra reasonably priced automobiles to promote. However correcting the issue will take time. You’re nonetheless prone to discover reasonably priced automobiles briefly provide on many gross sales tons.

Older, Much less Costly Automobiles More durable To Discover

If you happen to hope to seek out an older automobile and your finances is lower than $15,000, these automobiles stay briefly provide. Extra would-be new automobile customers began shopping for up the out there used autos, drawing down the stock.

Plus, People are holding onto their automobiles longer than ever. The common automobile on American roads is now 12.5 years previous. Automakers additionally produced fewer automobiles for a number of years after the 2008 recession. That leaves fewer higher-mileage, older used autos out there to promote.

Essentially the most accessible used automobiles are priced between $15,000 and $30,000. Used automobiles priced below $15,000 stay difficult to seek out.

Tips on how to Purchase a Automotive Proper Now

If you’d like a brand new or used automobile, be ready for sticker shock. For brand spanking new automobiles, costs stay about 18% larger than three years in the past when the pandemic appeared endless. However take inventory that your subsequent automobile will possible last more and enable you to drive safer than ever with all of the technological advances and choices.

RELATED: Shopping for Older, Used Automobiles in 2024

Car high quality research repeatedly present that right this moment’s new automobiles endure fewer issues than these from only a few years earlier. Meaning consumers of higher-priced used automobiles will possible see the automobile driving on the highway even longer. The identical goes for these shopping for new ones.

With most automakers now constructing such sturdy automobiles, they compete by including extra high-tech options. Options like adaptive cruise management and Apple CarPlay at the moment are extra frequent than ever on entry-level autos. Learn on to see our tips about shopping for a automobile under.

Tips on how to Leverage Incentives to Purchase a New Automotive

Automotive incentives made up 5.5% of the typical deal in December — up from 2.7% a 12 months earlier than. To reap the benefits of incentives, examine our month-to-month finest automobile offers to seek out supplier or producer incentives, together with money again and decrease rates of interest for financing your subsequent automobile.

RELATED: Tips on how to Purchase a New Automotive in 10 Steps

Promoting a Automotive Proper Now

Few of us can promote a automobile with no need to purchase a alternative. However, if that’s you, what are you ready for? You’re going to get extra on your automobile right this moment, and that’s good news. One of the simplest ways to get essentially the most cash on your used automobile is to promote it privately. However in case you don’t need the effort, there’s nonetheless a possibility to promote to a dealership.

PRO TIP: If promoting a automobile, take into account promoting it peer-to-peer utilizing Kelley Blue Guide’s Non-public Vendor Change market. It’s a low-cost methodology that helps customers earn extra for his or her automobile than promoting to a dealership.

Buying and selling In a Automotive Now

Falling used automobile costs imply rather less on your trade-in. However the ongoing scarcity of used automobiles might be with us for years. You’ll nonetheless possible see respectable affords on your used automobile this month.

Trying to find an honest worth on your trade-in continues to be a good suggestion by procuring it round. Every dealership tries to maintain a stability of autos on its lot. Generally, the one you need to purchase from doesn’t want your trade-in desperately, however a competitor does.

Analysis your automobile’s Kelley Blue Guide worth, then name a number of native dealerships to see what they’ll give you for it. Or strive our On the spot Money Provide software, which brings the deal to you from numerous dealerships with out obligation. You’ll be able to select your most popular provide or use it to barter with others.

Wanting Forward

In keeping with the Cox Automotive/Moody’s Analytics Car Affordability Index, new automobile affordability worsened barely in December however improved via most of 2023. “Because of a rise in common transaction costs, new-vehicle affordability worsened month over month in December,” stated Cox Automotive Chief Economist Jonathan Smoke. “Nevertheless, 12 months over 12 months, it’s in a lot better form, and new-vehicle mortgage charges are down from their peak in October.”

Easing inflation might relieve automobile consumers if the Federal Reserve decides to decrease charges in 2024, which might additional impression automobile mortgage rates of interest.

RELATED: 10 Finest Used Automotive Offers

Suggestions for Shopping for a Car Proper Now

If you happen to store proper now, we suggest a number of methods that can assist you discover the precise new or used automobile that matches your finances.

- Broaden your search. Widen your search to a broader geographic space.

- Keep affected person. Name dealerships early and infrequently to see what’s coming off the vans for these harder-to-find autos. Go away a refundable deposit if you would like first dibs.

- Purchase a inexpensive mannequin. With larger automobile mortgage rates of interest, take into account shopping for a less expensive automobile mannequin as a substitute of a costlier one within the lineup you’re contemplating.

- Perceive the timing. Be ready to buy a number of weeks, and understand it entails calling or visiting a number of dealerships as you search for the precise match.

- Don’t bounce. Store round your trade-in as aggressively as you hunt down the precise automobile. Don’t settle for the primary provide. You possibly can promote your self quick.

- Weigh your choices. Don’t simply search for a automobile; seek for the most effective rates of interest from banks or credit score unions. Then, weigh all of your choices, together with financing incentives and offers on the dealership, if that’s the place you purchase your subsequent automobile. Additionally, you could discover the worth variations of some newer mannequin used autos are nearly the identical as new automobiles. Simply preserve all of your choices open throughout your search.

- Don’t pay supplier markups. If you happen to see a markup, typically known as a market adjustment, in your closing bill, ask that it’s eliminated or store at one other dealership.

- Query all add-ons. In case your gross sales abstract consists of entries like “window tint” or “material safety” and different add-ons you didn’t request, ask for these line gadgets to be eliminated out of your bill. Many sellers tack on these extras to make fast earnings.

It could make sense to maintain your current automobile for one more 12 months. If you happen to should purchase, be ready to take wonderful care of your subsequent automobile to maintain it working for a very long time.

Associated Articles About Automotive Shopping for and Promoting:

This text has been up to date because it was first revealed.

[ad_2]