[ad_1]

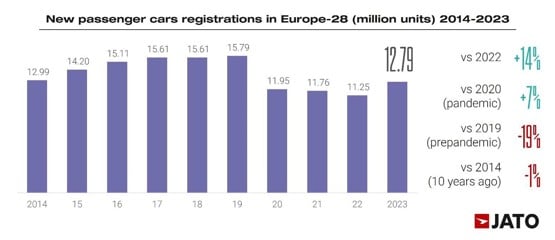

Gross sales of latest automobiles throughout Europe final yr reached 12.79 million items, exactly three million beneath the 2019 peak however the highest consequence for the reason that COVID pandemic.

The consequence was nearly the identical as 2014’s European market. The primary markets driving the expansion have been the UK, France, Italy, Spain, Belgium, Portugal, Croatia and Cyprus.

“Europe’s automotive market seems to be normalising. Provide chain points are actually largely below management, and shoppers have turn into accustomed to ready longer to obtain new automobiles. Regardless of this, it’s unlikely we are going to see volumes surpass the 15 million items recorded in 2019. Buying a automobile has turn into costlier, and attitudes to possession proceed to vary,” mentioned Felipe Munoz, international analyst at JATO Dynamics.

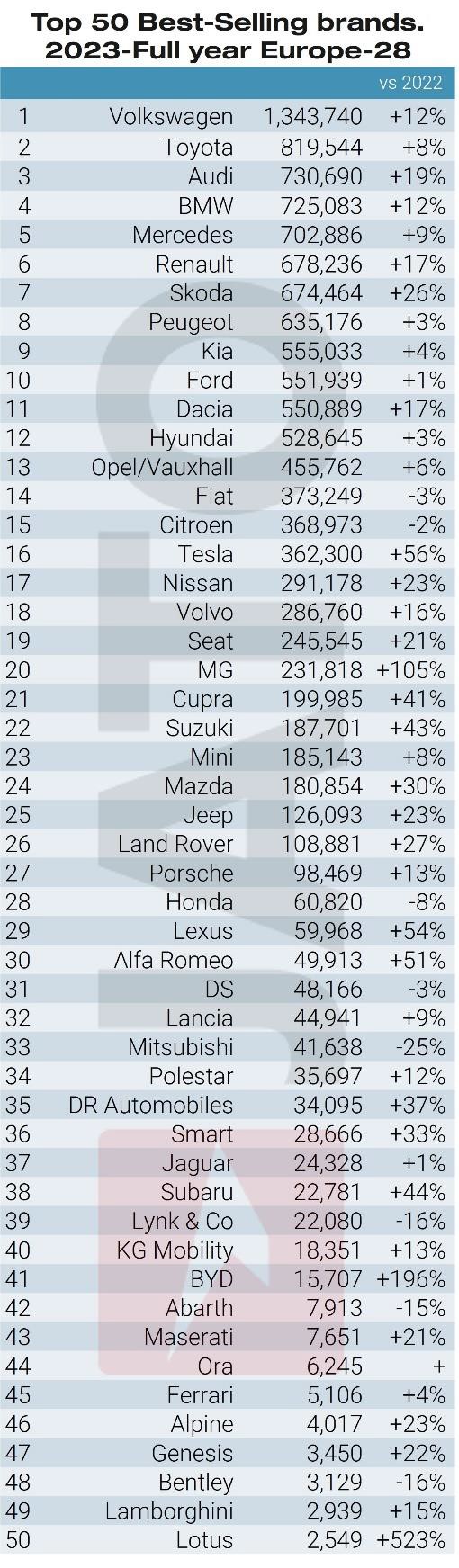

Germany’s Volkswagen Group held the biggest market share in Europe in 2023, rising to 25.8% from 24.7% in 2022. Its Volkwagen, Audi, Skoda, Seat and Cupra manufacturers all gained market share final yr, which JATO mentioned was a results of their robust EV line-ups and enticing offers for older fashions such because the Audi A4, A1, and Q2 and the Seat Ibiza.

The Tesla Mannequin Y turned Europe’s most-registered mannequin in 2023 – each the primary time a non-European mannequin and an electrical mannequin have led the rankings – due to the Tesla Mannequin Y’s dominance of latest automotive markets in Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland.

The Tesla Mannequin Y turned Europe’s most-registered mannequin in 2023 – each the primary time a non-European mannequin and an electrical mannequin have led the rankings – due to the Tesla Mannequin Y’s dominance of latest automotive markets in Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland.

JATO mentioned a lot of the expansion in Europe’s new automotive market in 2023 was pushed by BEVs (battery electrical automobiles), which accounted for 15.7% of complete market share with 2,011,209 items registered. This marks a brand new excessive for the class, and cements Europe’s standing because the world’s second largest marketplace for BEVs, behind China (~5 million items) however forward of the US (1.07 million items).

JATO mentioned a lot of the expansion in Europe’s new automotive market in 2023 was pushed by BEVs (battery electrical automobiles), which accounted for 15.7% of complete market share with 2,011,209 items registered. This marks a brand new excessive for the class, and cements Europe’s standing because the world’s second largest marketplace for BEVs, behind China (~5 million items) however forward of the US (1.07 million items).

However attracting extra non-public patrons to spend their very own cash on a BEV continues to be an industry-wide problem. Solely 39% of general BEV registrations have been made by non-public patrons, down 9 factors from 2022

“Though development stalled in November after which fell sharply in December, incentives are persevering with to assist BEV uptake throughout Europe. However when wanting on the information by registration sort, it turns into clear that incentives are solely at present interesting to corporations, fleets and leases,” Munoz mentioned.

“The dearth of curiosity from non-public patrons is a significant hurdle for the {industry} to beat. Gross sales to personal people are usually probably the most worthwhile for carmakers, and so it’s crucial that they do extra to draw such a buyer.”

The variety of Chinese language manufacturers now promoting new automobiles in Europe elevated from 23 to 30 throughout 2023, in line with JATO, nevertheless solely eight of those achieved greater than 1,000 registrations and MG accounted for 72% of all Chinese language manufacturers’ 321,918 new automotive gross sales in 2023.

“Though Chinese language manufacturers recorded a file market share of two.6% in 2023, up from 1.7% in 2022, claims of an “invasion” have been overstated,” mentioned Munoz.

He added: “MG is benefitting from providing aggressive and interesting merchandise made in China however making use of its standing as a legacy British model.”

[ad_2]