[ad_1]

Whereas buyer satisfaction with the seller service expertise has rebounded this 12 months, sellers proceed to grapple with elements and labor shortages which are fueling longer wait instances for appointments, in response to the J.D. Energy 2024 U.S. Buyer Service Index (CSI) Research,SM launched immediately. Total customer support satisfaction improves 5 factors to 851 (on a 1,000-point scale).

“It’s encouraging to see an enchancment in service satisfaction however, sadly, the capability and wait time points have gotten progressively worse for the reason that pandemic and present no instant indicators of easing up,” mentioned Chris Sutton, vice chairman of automotive retail at J.D. Energy. “Excluding Tesla homeowners, the service expertise for BEV homeowners is underwhelming. As gross sales of BEVs proceed to develop and the trade strikes out of the early-adopter part, the standard proprietor is not going to be as prepared to tolerate a less-than-stellar service and possession expertise. On the producer facet, the next fee of BEV recollects can be contributing to an inconsistent expertise. That is an space that automakers and sellers want to handle now to assist make the transition to electrification as pain-free as attainable for homeowners sooner or later.”

Contributing to the poor service expertise of non-Tesla BEV homeowners is a notable lack of belief with servicing sellers to carry out complicated repairs and supply helpful steering. Total seller belief amongst non-Tesla BEV homeowners is 5.62 (on a 7-point scale) however jumps to six.00 amongst homeowners of gas-powered automobiles homeowners and 5.74 amongst plug-in hybrid (PHEV) homeowners.

The examine, now in its forty fourth 12 months, has grown to incorporate rising options akin to valet service, cellular automobile servicing and on-line/smartphone app cost choices to gauge the impact these processes have on the service expertise. The examine measures satisfaction with service at franchised seller or aftermarket service amenities for upkeep or restore work amongst homeowners and lessees of one- to three-year-old automobiles. It additionally supplies a numerical index rating of the highest-performing automotive manufacturers bought in america, which is predicated on the mixed scores of 5 measures that comprise the automobile proprietor service expertise. These measures are (so as of significance): service high quality; service advisor; automobile pick-up; service facility; and repair initiation. In 2023, mannequin phase rankings had been added to the examine to distinguish between the service wants of automobiles, vans, SUVs and minivans.

Following are key findings of the 2024 examine:

Appointment wait instances for mass market automobiles proceed to extend: On common, homeowners of mass market automobiles wait 5.2 days for an appointment on the seller, up from 4.8 days in 2023, whereas homeowners of premium automobiles wait 5.4 days—barely higher than a 12 months in the past. Wait instances in each segments are nonetheless considerably greater when put next with pre-pandemic ranges.

Prospects need immediate service appointments: Longer wait instances at sellers are driving extra prospects to aftermarket service amenities. Amongst prospects within the mass market phase, 35% now select aftermarket service due to the power to be seen immediately, surpassing cheaper prices (34%) as a purpose for selecting such service. Notable, too, is that 55% of consumers select aftermarket service as a consequence of comfort of location.

Know-how improves service expertise: Utilizing expertise is a vital a part of enhancing the service expertise. Prospects are 4 instances as prone to point out they wish to get service updates through textual content message (68%) than a cellphone name (16%). Moreover, when service advisors present pictures or movies to help the outcomes of a multi-point inspection (MPI), buyer satisfaction with their advisor improves 31 factors than when no pictures or movies are shared (911 vs. 880).

Quantity spent per seller go to continues to climb: Through the previous two years, the typical quantity spent on a current seller service go to has risen 30% for homeowners of each premium and mass market automobiles. Homeowners of premium automobiles pay a median of $380, up $66 from 2023, whereas homeowners of mass market automobiles pay $140, a year-over-year enhance of $15. Amongst prospects whose service isn’t lined by guarantee or a upkeep contract, these will increase might be attributed to inflation and better prices for elements and labor.

Non-Tesla BEV homeowners are the least happy of all of them: Homeowners of non-Tesla BEVs expertise recollects barely greater than twice as typically as do homeowners of gas-powered automobiles. Compounding the issue, general service satisfaction with recall work is 782 amongst these affected homeowners—50 factors decrease than amongst homeowners of gas-powered automobiles (832). The truth is, non-Tesla BEV homeowners have the bottom satisfaction with recall work throughout all different main automobile classes, together with diesel (831), hybrids (827) and PHEVs (821).

Highest-Rating Manufacturers and Segments

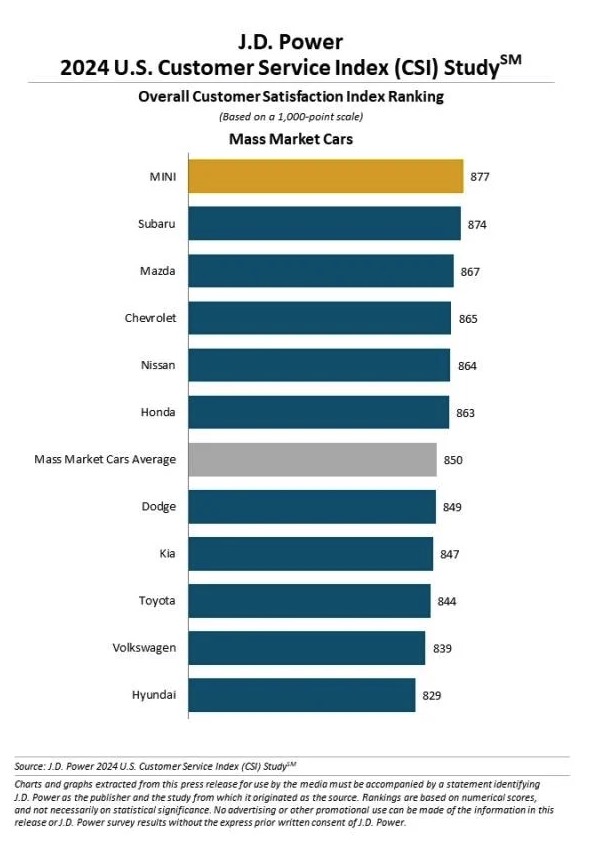

Buick ranks highest in satisfaction with seller service amongst mass market manufacturers with a rating of 887. MINI (884) ranks second and Subaru (877) ranks third.

Buick ranks highest amongst mass market SUVs/minivans with a rating of 887. Mitsubishi (877) and Subaru (877) every rank second in a tie.

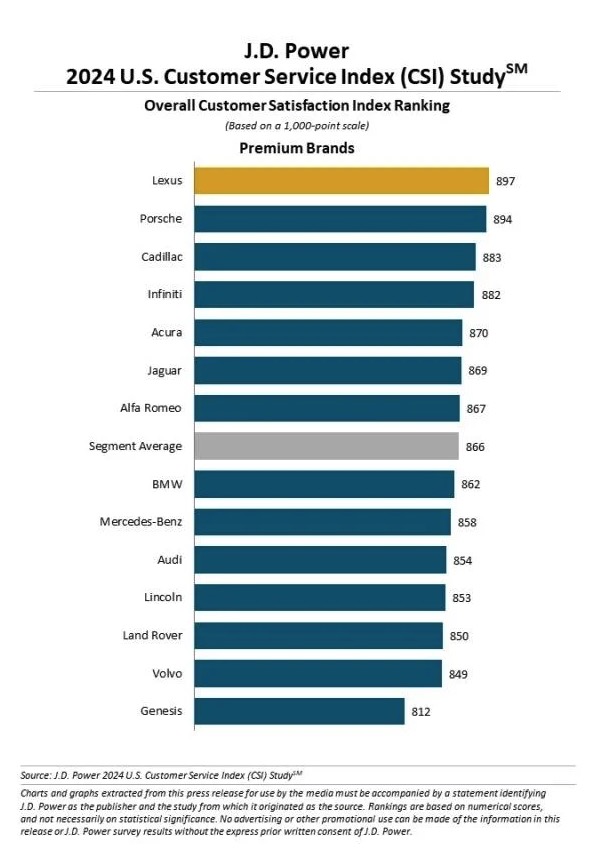

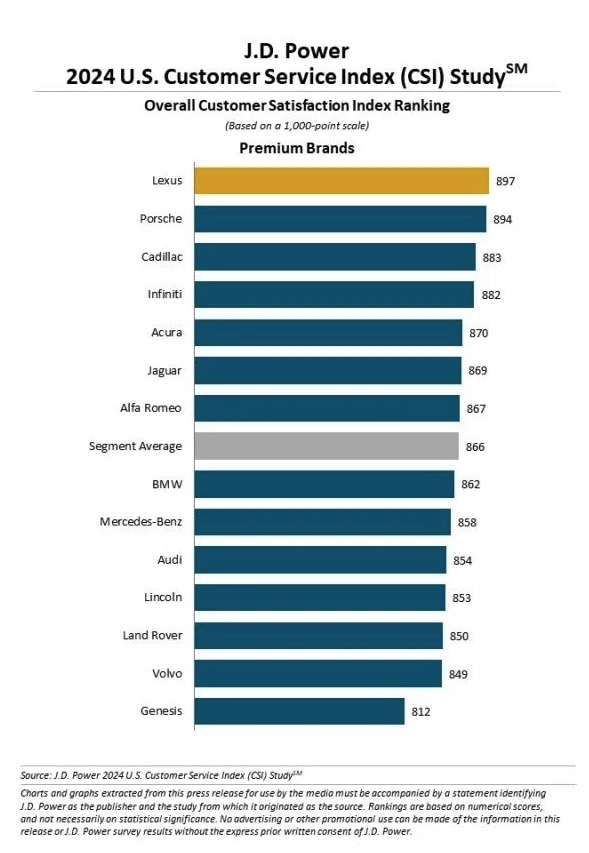

Porsche (902) ranks highest within the premium automotive phase, adopted by Infiniti (900) and Lexus (892).

Lexus ranks highest within the premium SUV phase for a second consecutive 12 months, with a rating of 898. Porsche (889) ranks second and Cadillac (882) ranks third.

Nissan ranks highest within the truck phase for a second consecutive 12 months, with a rating of 873. Chevrolet (856) ranks second and Toyota (855) ranks third.

The 2024 U.S. Buyer Service Index (CSI) Research is predicated on responses from 64,781 verified registered homeowners and lessees of 2021 to 2023 model-year automobiles. J.D. Energy goes to nice lengths to make sure that survey respondents are true homeowners of the model they’re representing. The examine was fielded from August by way of December 2023.

[ad_2]