[ad_1]

Affording a Automobile Fast Details

At present’s automotive gross sales market is a blended bag of not-great and not-so-good information. What needs to be occurring doesn’t appear to be occurring — not less than not but. New automotive costs stay on the producer’s prompt retail value (MSRP) with some discounting regardless of greater rates of interest. Used automotive costs are falling, however stock is skinny. It’s an attention-grabbing marketplace for patrons with a trade-in. The scenario leaves many automotive business analysts scratching their heads.

As shoppers, one of many questions we search steerage on is, are you able to afford to purchase a automotive proper now? Our reply is sure, with a number of situations. Let’s dig a bit of deeper and see if we are able to ease a few of the uncertainty.

What’s Occurring With Automobile Costs Proper Now?

We might want to begin with present pricing developments to get a deal with in your skill to afford a automotive proper now.

What Is the Common Value for a New Automobile?

In accordance with information from Cox Automotive, the father or mother of Kelley Blue E book, the typical value a purchaser paid for a brand new automotive in November 2023 was $48,247.

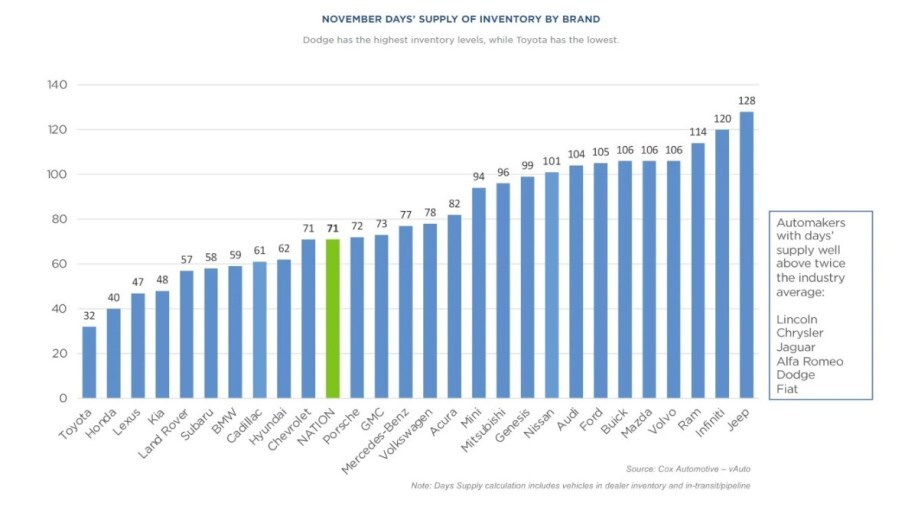

Cox Automotive vAuto information exhibits that stock shortages on the finish of 2023 nonetheless hamper Toyota, Honda, Lexus, Kia, and Land Rover. However you’ll discover loads of new Lincoln, Chrysler, Jaguar, Alfa Romeo, Dodge, and Jeep autos.

Whether or not new or used autos, negotiating a greater value from sellers at the moment is rather more difficult than earlier than the COVID-19 pandemic. Easy economics tells us that costs will stay elevated for these autos till the provision of fashions exceeds demand. On the similar time, others might land you a greater deal.

What Is the Common Value for a Used Automobile?

In accordance with Cox Automotive, the typical used automotive transaction value in November 2023 was $26,553. Nonetheless, developments present some ache factors for used vehicles that will persist via the primary a part of 2024. Wholesale costs sellers pay for used vehicles at public sale started falling. Nonetheless, the nationwide stock of used vehicles on the market is shrinking. These aren’t nice developments for buyers trying to purchase used autos.

The place Are Automobile Costs Going?

Rising rates of interest started forcing down transaction costs for brand spanking new and used autos final yr. However rates of interest for automotive patrons are steadily declining, and that’s nice information.

Sure, new automotive inventories began returning to regular, however some carmakers nonetheless face depleted inventory on choose fashions just like the Toyota Camry or Honda CR-V. Odds are costs will stay excessive on these and different Asian model autos within the brief time period.

Within the used automotive market, future provide shall be constrained. Lean inventories of used autos will maintain costs greater. Consumers priced out of the new-car market and into the used provides to the pricing strain.

RELATED ARTICLE: When Will New Automobile Costs Drop?

How Do Automobile Mortgage Curiosity Charges Affect Buy Value?

Each automotive mortgage has some transferring components that, when added collectively, outline how good a deal you scored in your automobile buy. The transaction value is the ultimate price of the automobile after the down fee, trade-in, charges, taxes, and so forth. It additionally displays your success in negotiating down the producer’s prompt retail value (MSRP).

What do stubbornly excessive automotive costs need to do with rates of interest? For shoppers, discovering the bottom rate of interest attainable is extra essential than ever when striving for automotive affordability.

How Do Curiosity Charges Affect Car Price?

Rates of interest on used automotive loans will nearly at all times be greater than on loans for brand spanking new vehicles.

Utilizing the automotive fee calculator from our sister firm, Autotrader, let’s make a fast comparability to see how the rate of interest (the price of the borrowed cash) can affect a automotive’s affordability. Keep in mind that your credit score rating, credit score historical past, and job historical past all affect the bottom rate of interest for which you qualify.

New Automobile Curiosity Price

In accordance with Bankrate, as of this writing, the typical rate of interest on a 48-month new-car mortgage is 7.65%. Let’s say you need to finance $30,000 for 48 months on the common price. That works out to $727 per thirty days for a complete of $34,919 paid over the lifetime of the mortgage. In different phrases, you’ll pay a complete of $4,919 in curiosity over 48 months. Financing that very same quantity for 48 months at 4.99% works out to $691 per thirty days and $33,156 over the 48-month lifetime of the mortgage. Shaving simply 2.66% from the curiosity will save $1,763 over the lifetime of the mortgage.

Used Automobile Curiosity Price

Utilizing Bankrate figures, the typical rate of interest on a 48-month used automotive mortgage is 8.35%. Let’s work that out to see the funds for financing $20,000. The month-to-month fee can be $492 per thirty days with a complete payback quantity of $23,594 or $3,594 in curiosity over the lifetime of the mortgage. Doing the identical math with an rate of interest of seven.35% curiosity works out to month-to-month funds of $482 and a complete payback of $23,145. Dropping 1% from the rate of interest saves $449 over 48 months.

Low APR Automobile Loans Are Out There

No-interest loans are tougher to search out, however digging for one of the best financing deal is a positive technique to make automotive shopping for extra inexpensive. Allyson Harwood, a senior editor for Kelley Blue E book, presents her tackle the present financing atmosphere.

“There are many nice offers on the market. We’ve noticed lease offers with low month-to-month funds on small and midsize SUVs. Moreover, there are a number of nice offers with a low APR. And, in case you are on the lookout for a truck, some producers have presents of low APR financing plus money again.”

RELATED: 10 Finest Automobile Offers

How A lot Automobile Can I Afford?

Pinpointing the precise automotive transaction value you’ll be able to afford isn’t a simple course of. Quite the opposite, it’s a tiresome and generally painful expertise. Figuring out how a lot automotive you’ll be able to afford requires being sincere about earnings and truthful about your spending. This little experience across the block on the truth bus isn’t nice for many people. Nonetheless, potential automotive patrons should do it. At the least we’ve got the Autotrader Automobile Affordability Calculator to assist with a few of the math. Autotrader is the sister web site to Kelley Blue E book.

Easy methods to Make a Month-to-month Funds

Making a month-to-month finances requires determining how a lot you spend every month. Listed here are a few of the bills it is best to embrace:

- Mortgage or lease

- Utilities (electrical service, gasoline service, and so forth)

- Phone (that is all prices associated to any landlines (when you nonetheless have one), smartphones, and web broadband prices)

- Insurance coverage (dwelling, renter’s, auto, life, medical, and every other insurance coverage not deducted out of your paycheck)

- Mortgage and bank card funds

- Groceries

- Leisure (meals out, films, cable, streaming companies, and so forth)

You will have to determine your internet earnings and create an inventory of your month-to-month bills. That’s, no matter you convey dwelling after taxes and any deductions for retirement, company-sponsored insurance coverage, and so forth. Subtracting your itemized bills from the web take-home pay is the quantity left for vehicle and miscellaneous bills. Keep in mind, you’ll at all times have further bills over and above your common itemized obligations. By no means overextend your finances for a automotive.

After you have decided what quantity you’ll be able to realistically put towards a automotive fee after calculating the price of gasoline, automotive insurance coverage, and month-to-month repairs, you’ll know the month-to-month automotive fee you’ll be able to afford. Strive utilizing our 5-year cost-to-own software to get estimates for automotive upkeep and extra. Plug that and the opposite requested info into the Autotrader calculator to land on a transaction value you’ll be able to stay with that’s in your finances.

TIP: Strive evaluating automotive insurance coverage utilizing our software to get a coverage estimate before you purchase.

Easy methods to Afford a Automobile in This Financial system

There isn’t any actual secret to affording a automotive within the present financial system. Primarily, you have to be keen to do the analysis and train persistence.

“It would take a bit of work to search out the precise mannequin and trim stage you’re on the lookout for with no vendor markup,” Harwood mentioned. “Subsequently, don’t be afraid to speak to a number of dealerships to search out what you need. And don’t be afraid to stroll away when you don’t just like the provide a vendor places in entrance of you.”

Pondering Exterior the Field to Create an Reasonably priced Automobile Mortgage

Getting a bit of artistic may also go a good distance in discovering an inexpensive path to getting a automotive. Listed here are a number of concepts:

- Accept a mannequin that’s not in brief provide: It’s possible you’ll have to compromise your needs to your wants. In case you have your coronary heart set on a Toyota, Kia, Honda, or another tough-to-get model or mannequin, you may contemplate setting your sights on one thing extra obtainable. Buick, Jeep, and Ram, amongst others, have wholesome inventories of autos. Not solely will sellers have a greater choice, however they’ll in all probability be extra keen to wheel and deal. They’re additionally extra prone to offer incentives on some fashions.

- Take a look at 2023 fashions: Positive, you desire a new 2024 mannequin. However you could possibly discover a newer 2023 model of the mannequin you need for hundreds much less. Once more, some strong financing and leasing offers could also be obtainable on final yr’s fashions.

- Shine up that trade-in: Jonathan “JB” Bradley, at present the web supervisor and previously the finance supervisor of Ed Voyles Kia in Chamblee, Georgia, says you can also make up most of your misplaced floor on (vendor) market changes by buying and selling in a automotive. “It’s an enormous variable,” he mentioned. “There’s not an entire lot you are able to do about rates of interest, however you can also make up most of your misplaced floor.”

- Purchase new: Even when you’ve been contemplating a used automotive, contemplate a brand new one. The rates of interest for brand spanking new are not less than a bit of decrease.

- Think about licensed pre-owned (CPO) vehicles: You’ll lower your expenses as a result of the automobile is used and it’s additionally backed by a CPO guarantee.

- Bigger down fee: The more cash you put down on a mortgage, the decrease the month-to-month funds and the much less curiosity you’ll pay. Nonetheless, Bradley says it’s a tradeoff. “Each $1,000 (down) saves you $17,” he approximates. “You should ask your self if it’s price it?” That cash might do you extra good in your financial savings account when you want a cushion because the financial system worsens.

- Take out a line of credit score: In the event you personal a house, a house fairness line of credit score (HELOC) is another choice to contemplate. “With a line of credit score,” Bradley mentioned, “you get a greater tax profit, plus you get to make use of that cash to your benefit.” Furthermore, you’ll be able to tailor the phrases of that line of credit score to suit your finances. We advocate you discuss to your monetary planner or tax advisor earlier than taking this route. A HELOC makes use of your private home as collateral for the mortgage, and shopping for a brand new automotive may not be well worth the threat of dropping your private home.

- Make extra funds: An thought hatched by the mortgage business is to pay your mortgage each two weeks reasonably than as soon as a month. In different phrases, in case your month-to-month automotive fee is $700, pay $350 each two weeks. It’s like paying an additional month’s fee every year. The automotive mortgage is paid earlier; consequently, you save on curiosity.

Learn Associated Articles:

[ad_2]