[ad_1]

Resilient partnerships will probably be important in navigating the financial and structural complexities of the retail panorama, in line with trade chief John O’Hanlon.

On the Automobile Remarketing Affiliation’s (VRA) newest seminar, the chief government of Waylands Automotive offered insights into how trade gamers may thrive in an ever-evolving automotive panorama the place adaptability and collaboration are paramount.

O’Hanlon spoke concerning the intricacies of the company mannequin the place producers will more and more undertake a direct gross sales strategy, stressing that there’s a delicate stability required to make sure success for all: the unique gear producer (OEM), the supplier, and most significantly, the client.

O’Hanlon recounted firsthand expertise of his work with one Waylands franchise, the place a collective effort achieved one of the best final result for all stakeholders. “As a result of all three are profitable, we’re in a terrific place. We labored extremely arduous to try to get one of the best final result for the OEM, for the supplier, and for the client.”

The Impression of Margin Shifts

One of many vital challenges, O’Hanlon famous, is the potential lower in revenue margins for sellers, notably these historically sturdy in retail. As costs rise, he identified that sellers do not essentially profit from elevated margins, forcing them to concentrate on quantity to beat rising prices. Nevertheless, the restricted market capability poses a problem, which is prone to result in winners and losers within the trade.

Above all, the shift to an company mannequin, whereas selling elevated automobile gross sales, presents challenges in sustaining historic revenue margins. “That little margin seize has an affect on our world,” he noticed, stressing the necessity for sellers to adapt to the brand new financial panorama.

“Company is based on promoting extra vehicles however each producer cannot promote extra vehicles. We have a restricted market. So we all know there’s going to be winners and losers as the chance for added gross sales is extra restricted than ever.”

Navigating The New Regular

With the producer taking management of finance, sellers should now work even tougher to ensure they don’t lose out, with O’Hanlon underscoring the significance of promoting finance as a gateway to promoting insurance coverage and different add-ons.

He warned that if financing is just not offered by the dealership, subsequent gross sales efforts threat changing into ever more difficult. “If we do not promote the finance, it’s rather more troublesome to promote insurance coverage,” he stated, pointing to the danger of potential friction factors within the buyer journey.

The shopper expertise turns into paramount, and O’Hanlon confused the necessity for flawless programs, well-resourced groups, and compelling provides from the outset. “What does good appear like? What beauty like for an company is unbelievable programs and once I say unbelievable programs, I imply each customer-facing and retailer-facing and we will work collectively when these programs are supported by extremely educated well-resourced dealership groups that may cope with the little bumps alongside the highway.”

Right here, there’s a essential function for the franchise supplier to play in guaranteeing that nice buyer expertise is the tip level, a product of what he calls company and dealership working intently in ‘a virtuous circle’. “If we will promote a automobile and it is easy and fantastic and the client feels on the centre of that have, then we’re profitable,“ he stated, including that this may naturally result in a brand new buyer possession cycle and buyer retention.

“A producer does not have that functionality right now. Maybe it is round understanding, perhaps it is round among the programs perhaps it’s across the development. However these are the friction factors we’re seeing.”

“Whether or not it is a Mercedes, whether or not it’s a Volvo, you will start to see a few of that ache are available in for them. How shortly they get by means of the educational curve would be the fascinating query. I do not know the place we’ll get to. I am ever hopeful as a result of there are some actual wins when it comes to stock, when it comes to velocity.”

The Electrical Revolution

Turning to the electrical automobile panorama, O’Hanlon mirrored on the strategic partnerships that Waylands has cast with manufacturers embracing electrification, noting the significance of selecting companions with a transparent industrial technique, recognising there’s a important function these partnerships may play in making the retailer’s job simpler and positioning them for achievement in that rising market.

O’Hanlon stated he had a novel alternative in 2017 to decide on the companions with which he needed to work, choosing manufacturers similar to MG, Kia, Volvo, and Polestar which every representing a definite facet of the market and who would seemingly contribute to the enterprise’ viability.

“When you have a look at the expansion that they are anticipated to realize, that makes my job as a retailer a lot simpler. If I can really profit from the arduous work and heavy lifting these manufacturers do by rising, I stand a preventing probability,” he stated.

Aftersales EV Challenges

O’Hanlon spoke of the aftersales challenges posed by the appearance of electrical autos, flagging the looming menace to conventional income streams, notably when it comes to the sale of oil and second companies.

O’Hanlon spoke of the aftersales challenges posed by the appearance of electrical autos, flagging the looming menace to conventional income streams, notably when it comes to the sale of oil and second companies.

“Our gross revenue is made up from some key components. Take a look at oil, 30% of my gross revenue comes from the sale of oil. Beneath the company mannequin, we have to promote over 23% extra vehicles simply to face nonetheless by no means thoughts to offset that aftersales loss.”

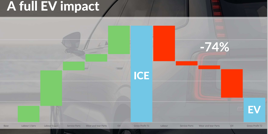

“If we went in a single day , then principally many of the work we might do could be on a second service – that will be 74% of my gross revenue – wiping out 75% of my internet revenue.”

“That is one thing that’s key to our viability so perceive that EV aftersales is coming – and, as a result of I place my model to promote extra new vehicles which might be electrical, I will be confronted with that sooner slightly than later.”

With a good portion of that gross revenue historically derived from oil gross sales, the shift to EVs necessitates subsequently a proactive strategy to aftersales companies, with O’Hanlon underlining the significance of annual Electrical Automobile Checks (EVC) and retention enchancment methods to offset that hit to aftersales income.

Partnerships, Future Scaling

Crucially, the evolving automotive panorama will necessitate a shift in dealership methods. On this, O’Hanlon advocates for scaling up and forming partnerships that perceive the intricacies of the dealership enterprise.

“Because the EV mandate grinds on,” he stated. “We all know we’ll need to promote increasingly more EVs. They will be just a few dealerships who will bounce on board who must fill showrooms. However that is not the reply. We have to be very diligent with the companions that we work with going ahead,” warning that “an empty showroom is perhaps higher than a showroom with the incorrect model.”

He predicted a shift within the optimum measurement of dealerships, stating: “I feel the times of the one web site, two-site dealership are going away. We have to get larger and future-scaling partnerships must be our focus.”

“We have to be working with companions who perceive our enterprise, we perceive what they’ll do, after which we will push ahead at a time when scale and velocity would be the important elements.”

“The challenges have grown when it comes to the sector we work in whether or not they be financial or whether or not they be structural. They have tougher and we have to perceive and work with sturdy partnerships by means of our companies to have the ability to remedy them.”

[ad_2]