[ad_1]

UK automobile manufacturing hit 1,025,474 items in 2023, in accordance with the newest figures printed at this time by the Society of Motor Producers and Merchants (SMMT)

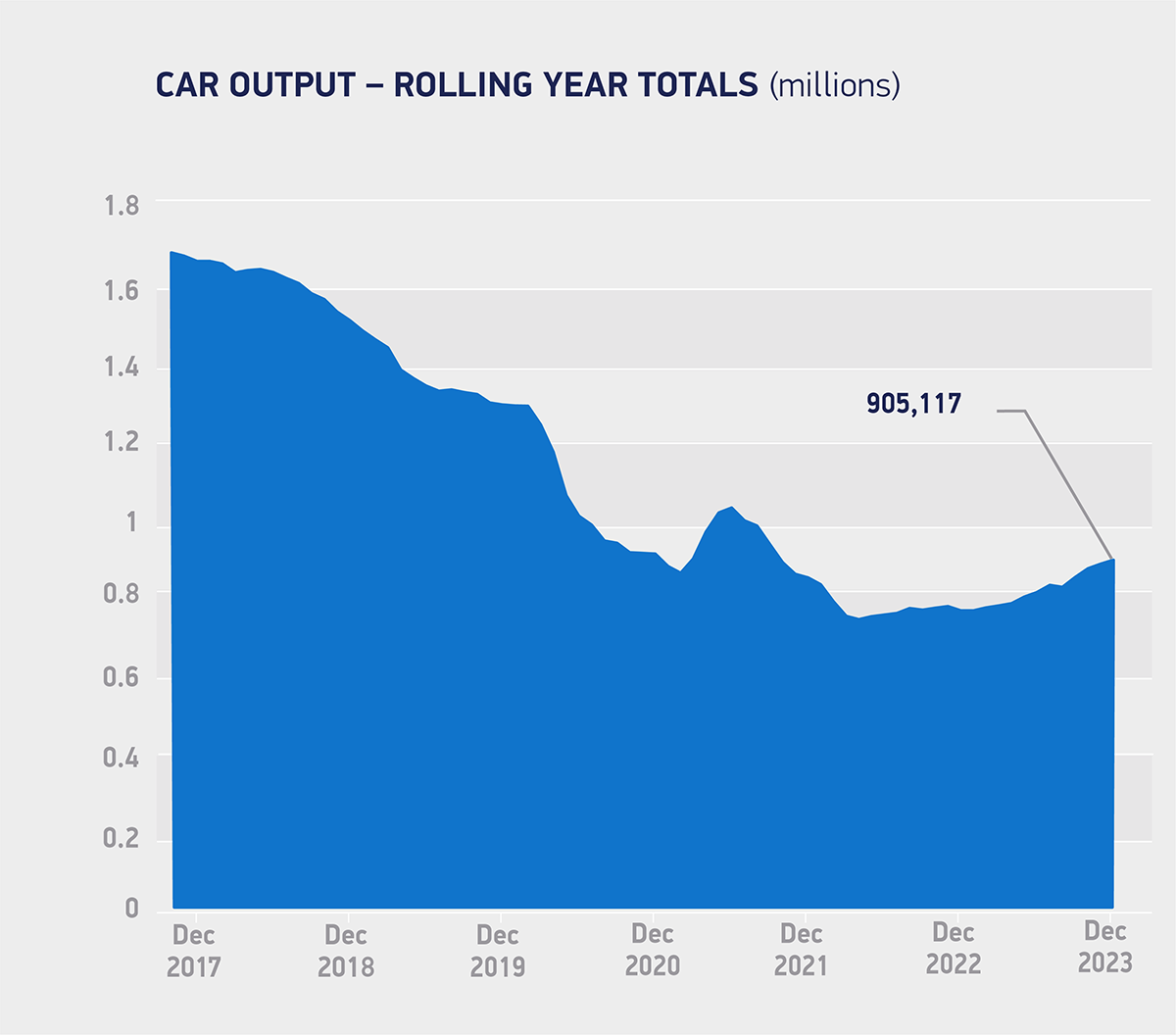

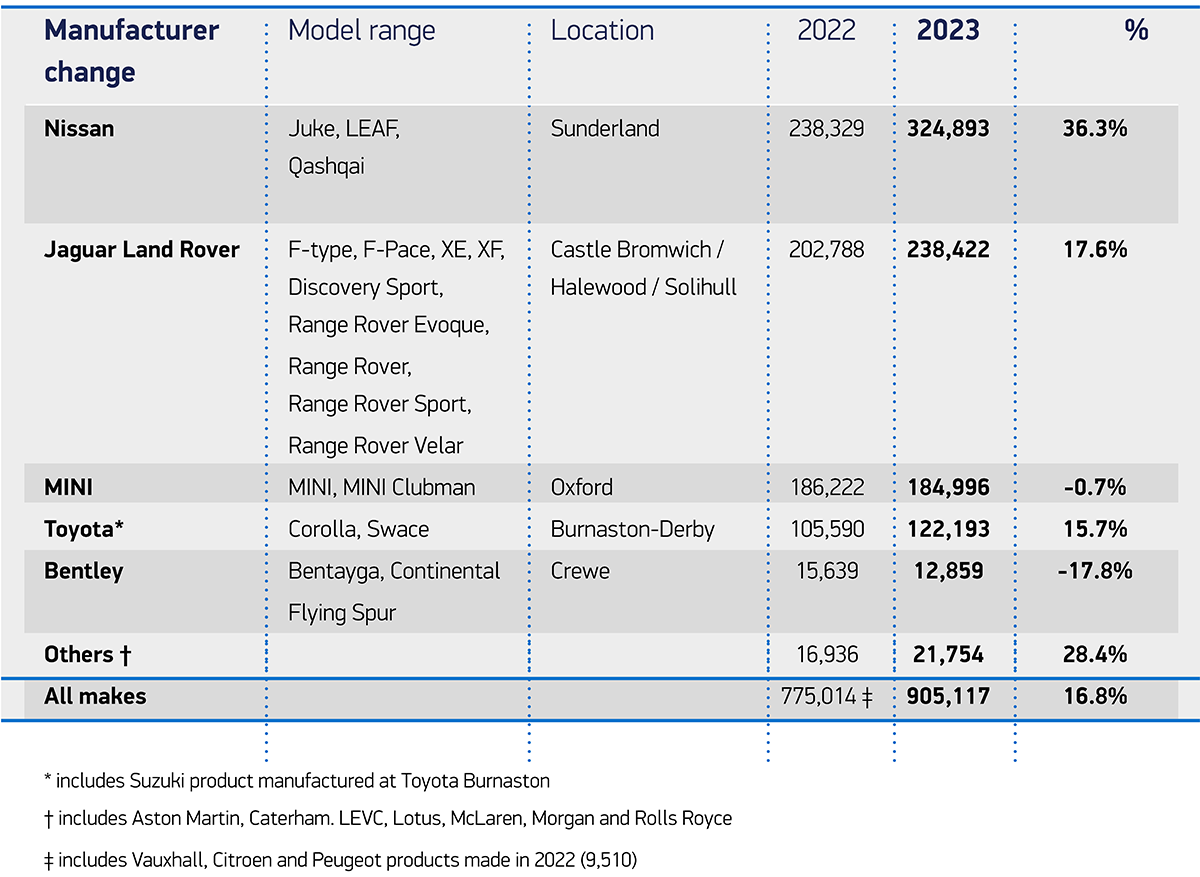

UK automobile manufacturing hit 1,025,474 items in 2023, in accordance with the newest figures printed at this time by the Society of Motor Producers and Merchants (SMMT). With 905,117 vehicles and 120,357 industrial autos (CVs) produced, output was up 17.0% on the earlier 12 months. The easing of pandemic-related challenges, from chip shortages to lockdowns, and rising electrified mannequin manufacturing, mixed to drive annual output above a million for the primary time since 2019.1

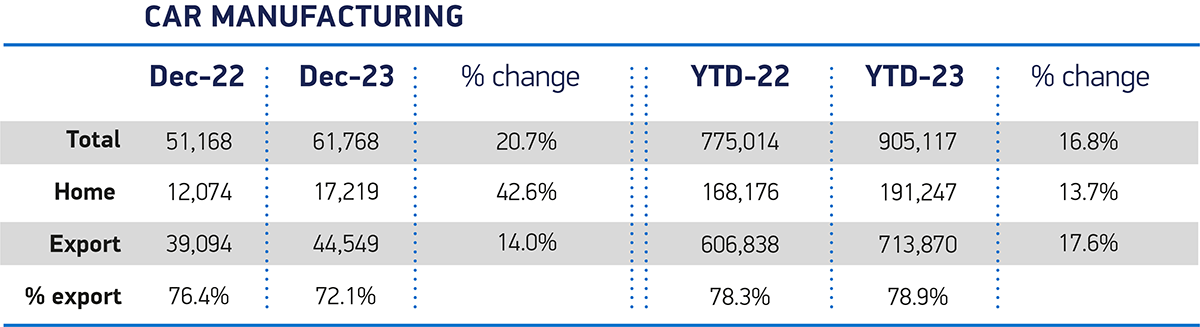

Sturdy December performances for each automotive manufacturing, up 20.7% 12 months on 12 months, and CV volumes, up 80.3%, rounded off a optimistic 12 months, which noticed a revival of the business’s fortunes. Eight all-new cutting-edge fashions entered manufacturing in 2023, together with on the newly reopened Ellesmere Port EV solely plant,2 whereas some £23.7 billion of personal and public funding commitments had been made – greater than within the earlier seven years mixed – from Cowley to Sunderland; gigafactories to R&D amenities.3

These commitments will drive inexperienced financial development, create jobs nationwide and transition the sector to electrified automobile manufacturing, which has already hit document ranges in 2023. UK manufacturing of battery electrical (BEV), plug-in hybrid (PHEV) and hybrid (HEV) autos surged to 346,451 items, up 48.0% on the 12 months earlier than to account for nearly two fifths (38.3%) of total output.

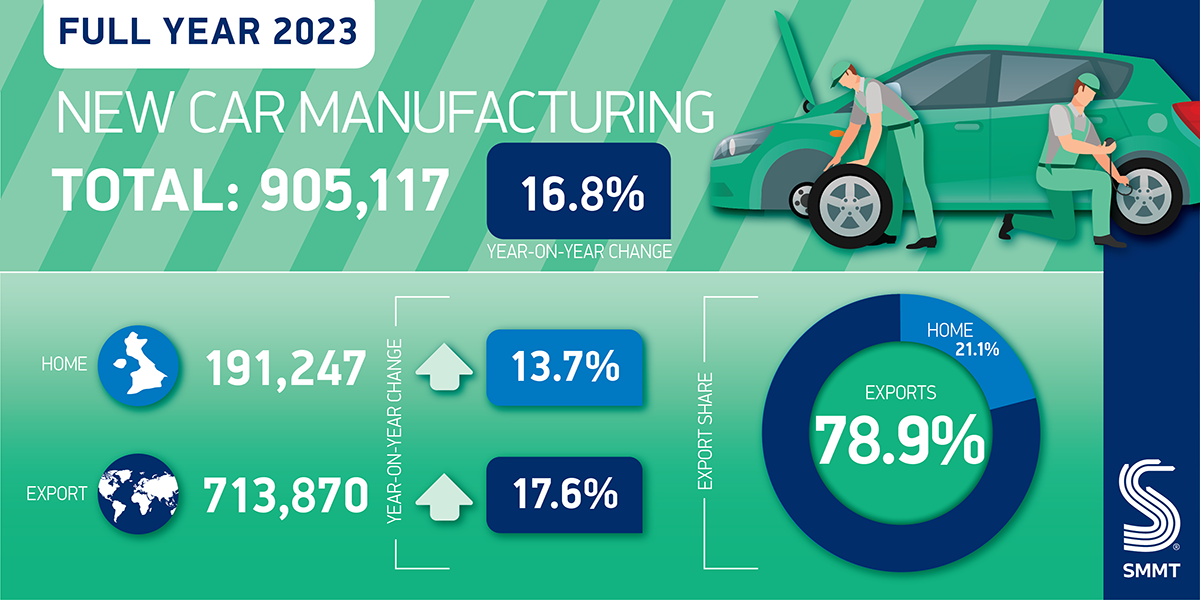

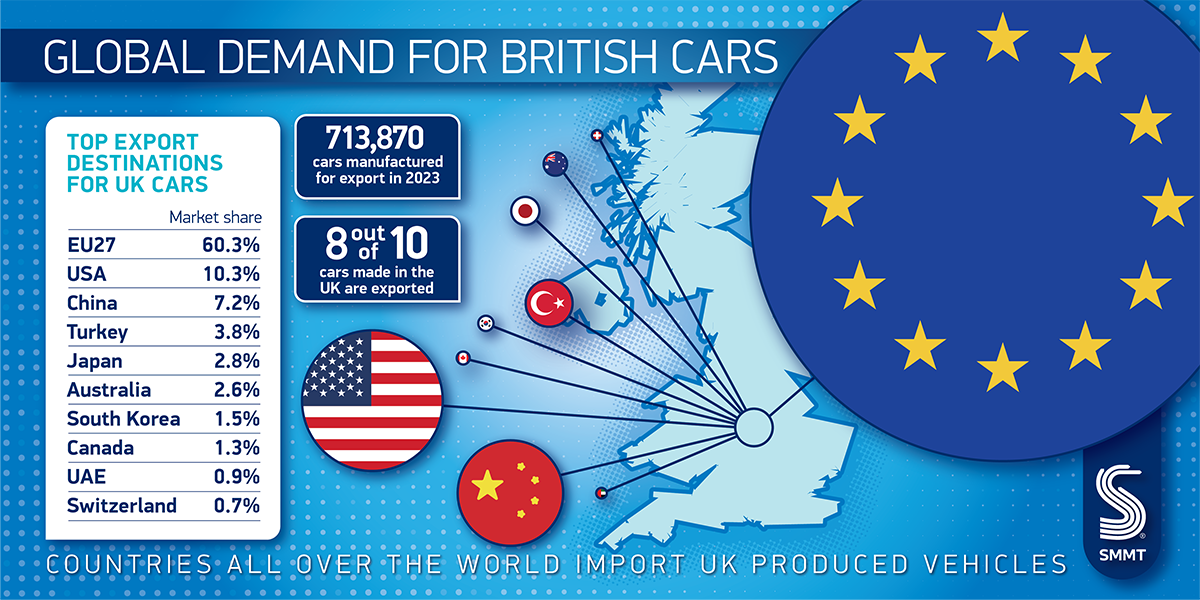

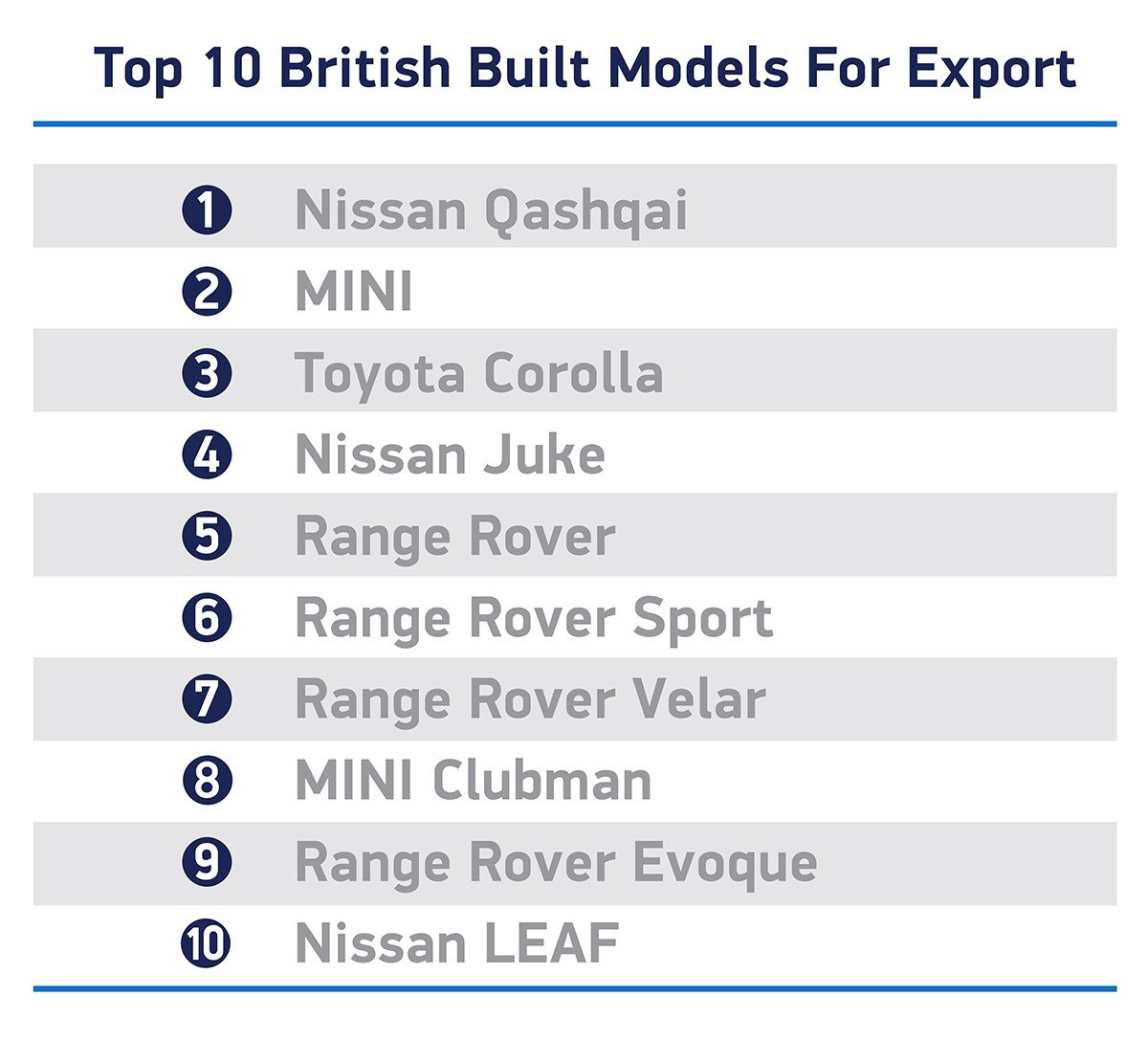

Total, UK automotive manufacturing rose 16.8% in 2023, its finest development charge since 2010, with the whole retail worth of all fashions made coming in at greater than £50 billion.4 Whereas 191,247 vehicles had been constructed for home patrons, the lion’s share of output was shipped abroad, proof of the contribution automotive exports make to the UK economic system. Yr on 12 months, exports rose 17.6% in contrast with a 13.7% rise in output for the British market.

The EU remained by far the sector’s largest international market, taking 60.3% of exports, with shipments up nearly 1 / 4 (23.2%) to 430,411 items. The US was the subsequent largest vacation spot with a ten.3% share of exports (73,571 items), adopted by China with 7.2% (51,202 items), regardless of shipments to each slipping by -9.1% and -2.7% respectively. Turkey, conversely, noticed exports surge 223.8% to 27,346 items, making it the UK’s fourth largest international market forward of Japan, Australia, South Korea, Canada, UAE and Switzerland.

Mike Hawes, SMMT Chief Government, stated,

Receding provide chain challenges, new mannequin introductions and a large £23.7 billion of funding put UK automobile manufacturing firmly again on observe in 2023. Trade will now concentrate on the supply of those commitments, transitioning the sector at tempo to electrical and scaling up the provision chain. With international competitors as fierce because it has ever been and amid escalating geopolitical tensions, each authorities and business should stay singularly targeted on competitiveness, with all the roles and development this can carry. We’re in a a lot better place than a 12 months in the past, however the challenges are unrelenting.

Regardless of difficult market situations, British specialist, luxurious and efficiency automotive makers had one other bumper 12 months, with mixed volumes climbing 6.3% to 34,613 items, value an estimated £7.1 billion.4 Two high-performance all new electrical fashions entered manufacturing, in Goodwood and Hethel, proof of how electrification is being embraced by producers proper throughout the sector.

The sector additionally obtained a lift on the very finish of 2023 with the deferral of more durable guidelines of origin for batteries and EVs traded between the UK and EU. The transfer will assist safeguard the competitiveness of the sector within the UK and Europe, offering beneficial time for native battery and related element manufacturing to ramp up.

2024 is a pivotal 12 months to make this occur however headwinds stay, most instantly with assaults on delivery within the Purple Sea elevating the spectre of delays and price pressures. Nonetheless, with the upcoming menace of UK-EU guidelines of origin tariffs overcome, the newest unbiased outlook foresees UK automotive and lightweight van output rising by round 3% in 2024 to 1.04 million items with the potential to exceed 1.2 million items by the top of this decade.

To realize this, the UK should guarantee it stays aggressive, and so the forthcoming Price range is a chance for presidency to introduce measures that may enhance the sector. These ought to embody extending Local weather Change Agreements so electrical automobile battery-manufacturing and its related provide chain are eligible for aid; making inexperienced vitality extensively obtainable and reasonably priced; delivering on commitments to enhance grid connections; and taking motion to shut important labour and expertise gaps.

Fast supply of the federal government’s Superior Manufacturing Plan, full implementation of the Harrington Evaluation suggestions, plus a commerce coverage that locations automotive on the coronary heart of all future negotiations would additionally assist the UK consolidate its restoration and grow to be a worldwide chief in more and more electrified automobile manufacturing.

1: 1,303,135 vehicles and 78,270 CVs made in 2019

2: Fashions from manufacturers: Aston Martin, Lotus, Rolls-Royce, Stellantis, Daf and Alexander Dennis

3: SMMT calculations primarily based on publicly introduced funding commitments, private and non-private, in UK automotive manufacturing and R&D 2023 from manufacturers together with however not restricted to: MINI, JLR, Tata and Nissan. Whole introduced funding 2016-2022 inclusive: £16.2 billion.

4: SMMT calculations primarily based on RRP and publically obtainable data – £51.6 billion.

SOURCE: SMMT

[ad_2]